Navigating the Crypto Bubble :- Understanding, Surviving, and Thriving in Volatile Markets.

Introduction :-

In recent years, the term “crypto bubble” has become increasingly prevalent in financial discussions of worldwide. As cryptocurrencies surge in popularity and market capitalization, the debate over whether the crypto market is experiencing a bubble has intensified. This blog post aims to develop deep into the concept of the crypto bubble, exploring its origins, characteristics, and implications for investors.

Moreover, we will provide valuable insights and strategies to help individuals navigate the volatile waters of the crypto market, enabling them to make informed decisions and potentially capitalize on opportunities while minimizing risks.

Table of Contents

Understanding the Crypto Bubble :-

To comprehend the crypto bubble phenomenon, it’s essential to first define what a bubble is in the context of financial markets. A bubble occurs when the price of an asset, such as cryptocurrencies, significantly exceeds its intrinsic value. In other words, speculative frenzy and market euphoria drive prices to unsustainable levels, eventually leading to a sharp and often dramatic correction.

The crypto bubble shares similarities with historical bubbles, such as the dot-com bubble of the late year of 1990s and the housing bubble of the mid-2000s. Like these bubbles, the rapid rise in cryptocurrency prices has been fueled by a combination of factors, including technological innovation, media hype, and investor speculation. However, it’s crucial to recognize that not all price surges in the crypto market constitute a bubble. Distinguishing between genuine value appreciation and speculative excess is key to navigating this complex landscape.

To truly grasp the dynamics of the crypto bubble, one must appreciate its underlying mechanisms and the factors contributing to its formation. While the crypto market is relatively young compared to traditional financial markets, it has already witnessed several boom-and-bust cycles, each characterized by exuberant optimism followed by steep corrections.

The emergence of the crypto bubble can be attributed to a combination of technological innovation, investor speculation, and broader socio-economic trends. Blockchain technology, the underlying infrastructure powering cryptocurrencies, represents a paradigm shift in how value is created, stored, and transferred. Its decentralized nature promises greater transparency, security, and efficiency compared to traditional financial systems, fueling optimism about its disruptive potential.

However, alongside the promise of blockchain technology, the crypto market has also attracted speculators seeking quick profits and opportunistic entrepreneurs capitalizing on investor enthusiasm. Initial Coin Offerings (ICOs), a fundraising method used by blockchain projects to issue digital tokens, witnessed unprecedented growth during the peak of the crypto bubble, with thousands of projects raising billions of dollars from investors worldwide.

Characteristics of the Crypto Bubble :-

Identifying the characteristics of the crypto bubble can aid investors in assessing market conditions and making informed decisions. Some key features of the crypto bubble include :-

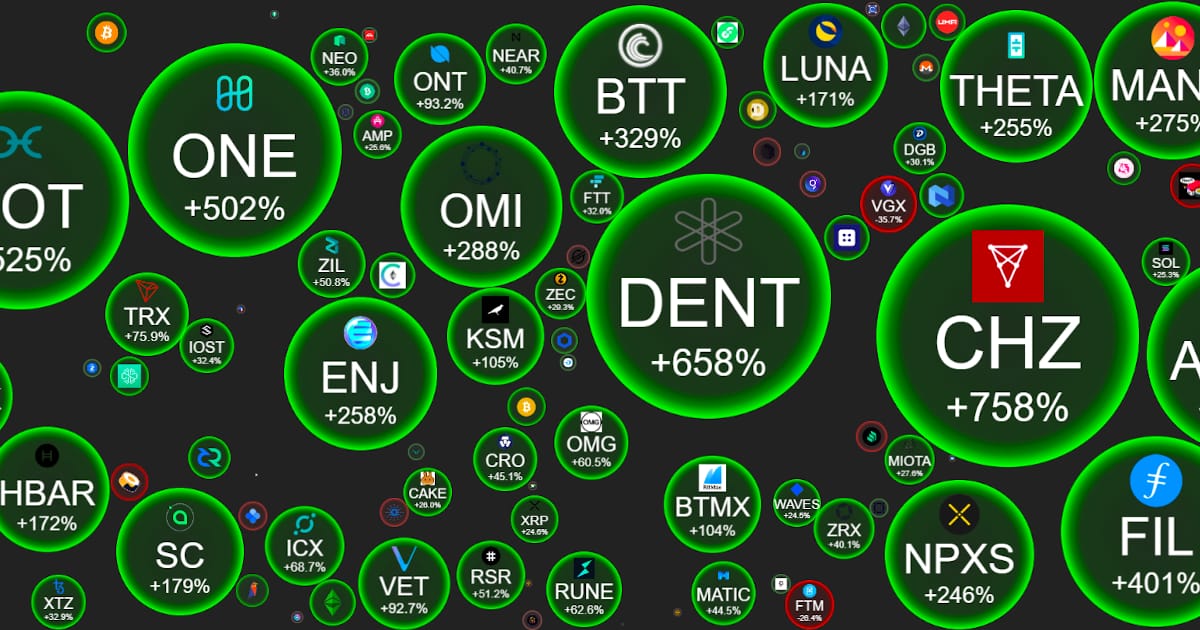

- Exponential Price Growth :- During a bubble, cryptocurrency prices often experience rapid and unsustainable appreciation, driven by speculative trading activity and herd mentality.

- Media Hype and Public Frenzy :- Positive news coverage, celebrity endorsements, and widespread social media discussions contribute to a euphoric atmosphere surrounding cryptocurrencies, attracting novice investors seeking quick profits.

- Irrational Exuberance :- Investors exhibit irrational behavior, disregarding traditional valuation metrics and pouring money into cryptocurrencies based solely on the expectation of future price gains.

- Volatility and Corrections :- Despite the upward trajectory, the crypto market is characterized by extreme volatility, with prices subject to sudden and significant fluctuations. Periodic corrections, or sharp declines in prices, often punctuate the bubble cycle, leading to panic selling and investor disillusionment.

- Proliferation of New Projects :- In a frothy market environment, new cryptocurrency projects emerge at a rapid pace, capitalizing on investor enthusiasm and promising innovative solutions to various challenges. However, not all of these projects are viable or sustainable in the long run, leading to a proliferation of ‘crypto scams’ and failed ventures.

Implications for Investors :-

For investors, navigating the crypto bubble requires a combination of caution, diligence, and risk management. While participating in the crypto market can offer lucrative opportunities, it also carries significant risks, especially during bubble-like conditions. Here are some implications to consider :-

- Risk of Loss :- Investing in cryptocurrencies involves the risk of substantial loss, particularly during market downturns and corrections. It’s essential to only invest what you can afford to lose and maintain a diversified portfolio to mitigate risk.

- Psychological Factors :- The fear of missing out (FOMO) and the fear of losing money (FOMO) can influence investor behavior during bubble periods, leading to irrational decision-making and herd mentality. Maintaining a disciplined approach and avoiding emotional reactions is crucial for long-term success.

- Due Diligence :- Conduct thorough research and due diligence before investing in any cryptocurrency or blockchain project. Evaluate the team behind the project, the technology, use case, market potential, and competitive landscape. Beware of red flags such as lack of transparency, unrealistic promises, and exaggerated claims.

- Long-Term Perspective :- Instead of chasing short-term gains, adopt a long-term investment horizon and focus on the fundamentals of the technology and underlying assets. Distinguish between genuine innovation and speculative hype, and invest in projects with strong fundamentals and real-world utility.

- Risk Management Strategies :- Implement risk management strategies such as setting stop-loss orders, diversifying your portfolio across different asset classes and cryptocurrencies, and avoiding excessive leverage. These measures can help protect your capital and minimize losses during market downturns.

Navigating the Crypto Bubble :-

While the crypto bubble presents challenges and risks, it also offers opportunities for savvy investors who can navigate the market effectively. Here are some strategies to help you navigate the crypto bubble and potentially thrive in volatile markets :-

- Education and Knowledge :- Continuously educate yourself about blockchain technology, cryptocurrencies, and the underlying principles of decentralized finance. Stay informed about market trends, regulatory developments, and emerging opportunities in the crypto space.

- Dollar-Cost Averaging (DCA) :- Instead of trying to time the market, consider implementing a dollar-cost averaging strategy, where you invest a fixed amount of money at regular intervals, regardless of market conditions. DCA can help smooth out volatility and reduce the impact of market fluctuations over time.

- Quality Over Quantity :- Focus on quality over quantity when selecting cryptocurrencies for your portfolio. Instead of chasing speculative altcoins with little substance, prioritize established cryptocurrencies with strong fundamentals, real-world use cases, and active development communities.

- Active Portfolio Management :- Monitor your portfolio regularly and be prepared to adjust your investment strategy based on changing market conditions. Take profits during bull markets to lock in gains and consider reallocating capital to undervalued assets during market downturns.

- Hedging Strategies :- Explore hedging strategies such as derivatives, options, and futures contracts to protect your portfolio against downside risk and volatility. While these instruments carry their own set of risks, they can serve as valuable tools for risk management in turbulent market environments.

Link :- https://exclusiveexpressnews.com/crypto-battle-the-crypto-cryptocurrency

Conclusion :-

In conclusion, the concept of the crypto bubble is a recurring phenomenon in the volatile and rapidly evolving cryptocurrency market. While bubbles can present lucrative opportunities for investors, they also pose significant risks and challenges. By understanding the characteristics of the crypto bubble, recognizing its implications for investors, and adopting prudent strategies to navigate market cycles, individuals can potentially capitalize on opportunities while safeguarding their capital.

Remember to exercise caution, conduct thorough research, and seek professional advice if needed. Ultimately, success in the crypto market requires patience, discipline, and a long-term perspective.